“Want to Open a Bank in Turkey? Here’s What You Really Need to Know”

A Clear, Straightforward CEO Briefing for Decision Makers

🏁 Let’s Start With the Truth

Opening a bank in Turkey is not easy — but it’s 100% possible if you have the right capital, partners, and local support. Turkey is a G20 country with strict banking laws, but also huge potential. You’re not entering a startup environment — you’re entering a high-barrier, high-reward market.

Turkey offers a unique intersection of opportunity and complexity for financial entrepreneurs seeking to establish a banking institution. With its young population, expanding fintech ecosystem, proximity to Europe and MENA markets, and an increasingly reformist regulatory environment, Turkey stands out as a lucrative but highly regulated jurisdiction for establishing a bank.

This guide provides a step-by-step strategic roadmap for founders, investors, and financial groups aiming to enter the Turkish banking sector.

The image, titled “Establishing a Bank in Turkey,” shows a businessman in a formal setting, dressed in a suit, signing a banking license agreement. In the background is the Turkish flag and the words “Establishing a Bank in Turkey.”

Why Establish a Bank in Turkey?

- Large and Underbanked Market: Over 85 million people, yet significant portions of the population still rely on cash or informal banking.

- Regional Influence: As a financial gateway to Central Asia, the Balkans, and the Middle East, a Turkish banking license opens cross-border potential.

- Robust Legal Infrastructure: Governed by the Banking Law No. 5411, the system ensures regulatory transparency — and, for those who qualify, sustainable returns.

- Growing Fintech Ecosystem: Integration with open banking APIs, real-time payment infrastructure (FAST), and startup-ready digital rails.

⚖️ Legal Framework: What You Need to Know

All banking activity in Turkey is strictly regulated by the Banking Regulation and Supervision Agency (BDDK).

Key Legal References:

- Banking Law No. 5411

- Turkish Commercial Code

- Capital Market Law (if securities business is involved)

- CBRT (Central Bank of the Republic of Turkey) Guidelines

✅ No bank may operate in Turkey without a license issued by BDDK.

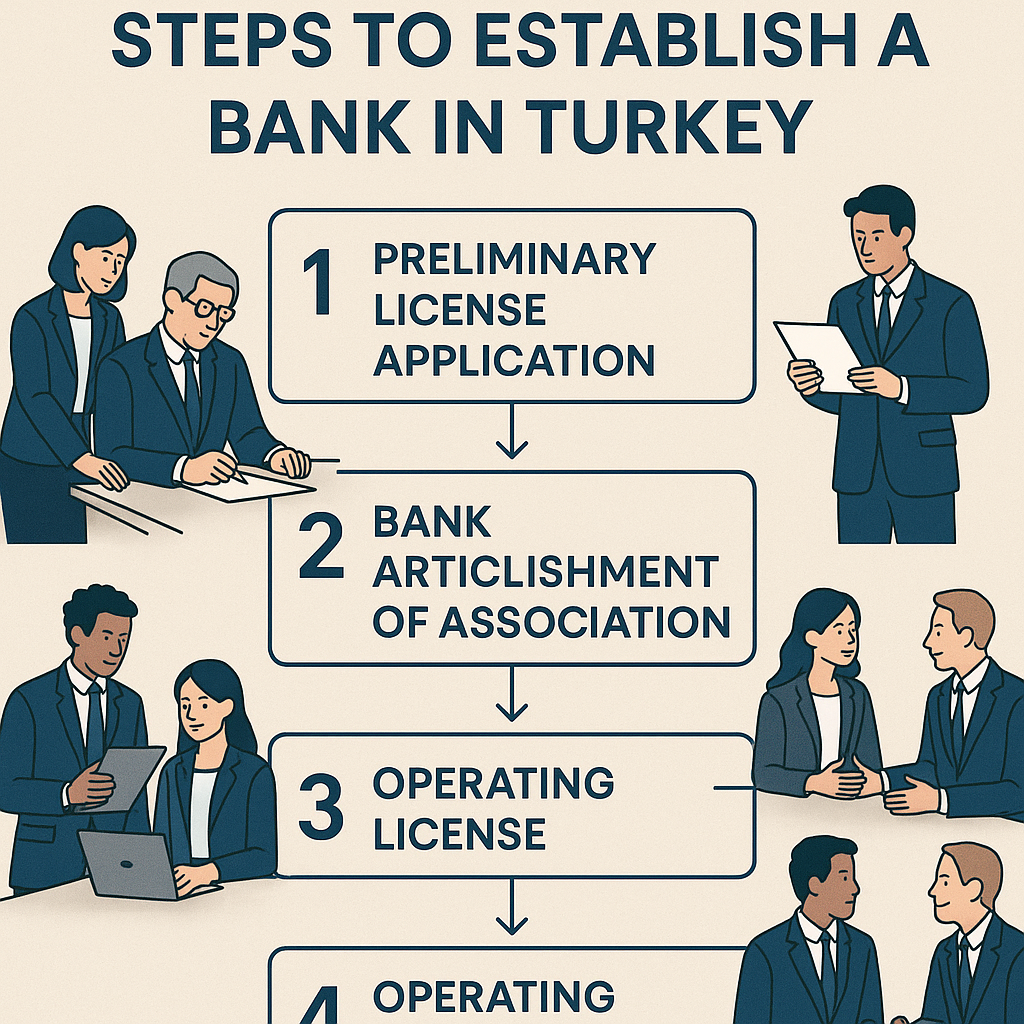

4 steps to establishing a bank in Türkiye

Form a Founding Group

- At least 5 real or legal persons must initiate the application

- Founders must have:

- No criminal record related to finance, fraud, or bankruptcy

- Demonstrated financial strength and credibility

2. Prepare a Founding Application

Must include:

- Business Plan (min. 5 years)

- Organizational Structure

- Shareholding structure

- Proof of paid-in capital (minimum: TRY 1 billion, ~USD 30 million as of 2025)

- Risk management and IT architecture plan

- Internal control and audit policies

3. Initial BDDK Approval

- BDDK evaluates the founders, capital adequacy, and feasibility

- Once approved, founders may proceed to establish the company legally

4. Formal Incorporation and Licensing

- Open legal entity at Turkish Trade Registry

- Deposit the entire capital in a blocked account at the Central Bank

- Establish all technical and operational infrastructure

- BDDK will conduct on-site inspections

- Final license issued once compliance is verified

⏱️ Typical timeline: 12–24 months

💰 Estimated Total Setup Cost: $30–50 million

Links To Help You:

1-) How to Set Up a Company in Turkey: Step-by-Step Guide

📎 For company formation basics, see our : Company Incorporation in Turkey Guide.

2-) “Digital Banking Licenses in Turkey: Everything You Need to Know”

📎 Interested in a leaner setup? Explore the Digital Bank Licensing Process.

3-) “MASAK Compliance for Crypto and Fintech Startups”

📎 Learn how to stay compliant with Turkish AML laws in our MASAK Compliance Guide.

🧠 Strategic Considerations for New Bank Entrants

🔹 Traditional Bank vs. Digital-Only Bank?

Turkey is highly receptive to digital banking. Consider applying for a “Digital Bank License” — a lighter regulatory route introduced in 2021 under BDDK’s fintech expansion policy.

Key benefits:

- Lower initial capital: TRY 500 million (~USD 15 million)

- Fully digital infrastructure (no physical branches)

- Open Banking compatibility

🚀 Ideal for: Neobanks, crypto-fiat banks, cross-border digital finance platforms

“Turkey isn’t just a market — it’s a strategic launchpad. If you have the capital and the courage to build a bank here, you’re not entering a country — you’re entering a region.”

– CEO Insight on Banking in Turkey

💼 Business Models to Consider

| Model | Key Features | Risk Level | Market Potential |

|---|---|---|---|

| Retail Bank | Mass market, loans, cards, accounts | Moderate | Very High |

| Corporate Bank | SME loans, treasury, trade finance | Moderate | High |

| Islamic Participation Bank | Sharia-compliant finance | Low | Niche but growing |

| Digital Neobank | App-based, low overhead | High (tech + trust) | Exploding |

| Crypto-Friendly Bank | Fiat-crypto integration | Regulatory risk | Untapped |

🏦 Banking Infrastructure & Ecosystem

- SWIFT Membership: Available upon license

- Interbank System (EFT & FAST): Real-time settlement via CBRT

- Credit Bureau Access: Turkish Credit Registry (KKB) integration

- E-Government (E-Devlet) API access: For customer verification (KYC)

🌍 Foreign Ownership Rules

- 100% foreign ownership is allowed, but:

- Founders must undergo enhanced scrutiny

- Capital must originate from legal, transparent sources

- Approval from Ministry of Treasury & Finance and CBRT may be required in parallel

📑 Compliance & Risk Requirements

- Basel III Standards: Fully implemented

- Minimum capital adequacy ratio: 8% (Tier 1 & Tier 2)

- Mandatory internal audit and compliance units

- Ongoing MASAK reporting (Anti-Money Laundering)

🧾 Taxation Overview

- Corporate Tax: 20%

- Withholding on dividends: 10%

- Banking & Insurance Transaction Tax (BSMV): 5% on certain services

- Incentives available for Tech-focused banks in Istanbul Financial Center (IFC)

🚫 Red Flags to Avoid

- Underestimating regulatory scrutiny: BDDK is among the most active financial regulators in the region

- Ignoring local legal representation: Turkish law requires deep local compliance expertise

- Attempting shortcuts on capital adequacy or shareholder transparency

🌟 Conclusion: A Bold but Bankable Move

Establishing a bank in Turkey is not for the faint of heart — it’s for visionary leaders who understand financial infrastructure as a tool of regional power.

If your group can meet the capital, compliance, and credibility thresholds, Turkey offers a strategic financial launchpad into Europe, Asia, and the Middle East — all from a single regulated entity.

Yanıt yok